The Employer Contribution or Benefits (ECBs) master file allows you to set up the ECBs to add to the employee records (Employees > ECB Information tab). ECBs are used to record the employer's share of an employee benefit (e.g., FICA, Medicare, 401K plan, employee's insurance). The benefit can be a benefit provided solely by the employer or it can be a benefit that the employer and employee contribute to, e.g., health insurance. ECBs allow the employer to withhold taxes on benefits provided for the employees (if applicable) as well as track the value of the benefits provided.

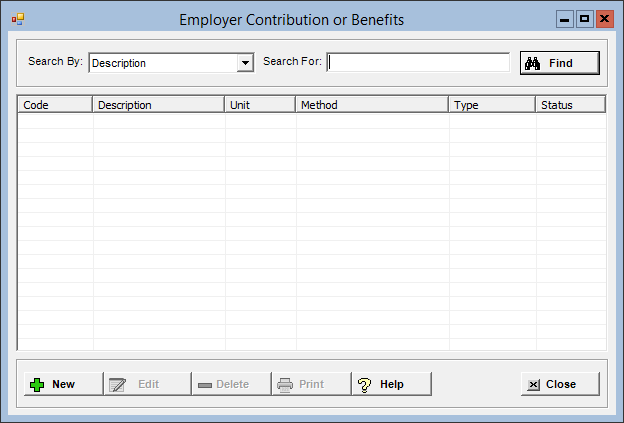

To access the Employer Contribution or Benefits window, go to Payroll > Master Files > Employer Contribution or Benefits. [+]

The following tasks can be performed from this window:

To display all ECBs on file, click Find without entering any search criteria. The grid displays the ECBs by Description in alphanumeric order. You can click any column heading to sort the list based on that column. Click the column heading again to reverse the order (i.e., ascending or descending).

Change or narrow your search results by entering specific search criteria:

In the Search By field, use the drop-down list to select how you want to search the list and sort the results. Select from the following sort options: Description or Code.

In the Search For field, enter the specific term to search for based on the Search By field choice. Enter all or part of the term to retrieve all records that match the criteria.

Click Find to display the search results in the grid.

Click New at the bottom of the Employer Contributions or Benefits window. The Add Employer Contribution or Benefits window is displayed. [+]

In the Code field, enter a unique, four-character alphanumeric code to assign to the ECB.

In the Description field, enter a full-text description of the ECB. This description is displayed on forms, reports, and direct deposit forms.

In the Unit field, use the drop-down list to select the code that determines how this ECB is treated in the Payroll application (e.g., FICA Tax, Medicare Tax, Federal unemployment).

2 - FICA Tax: Calculated from the federal tax table is recognized as the employer's share of FICA.

3 - Medicare Tax: Calculated from the federal tax table and is recognized as the employer's share of Medicare.

8 - IRA Match: Does not affect 941 reports or W-2s. This only tracks the contributions to an IRA for the employee and is reported to them. The employee contribution, which is a deduction, reduces their federal and state taxes each pay period, but is not reported on the 941 or W-2s.

9 - 401K, 403b, 457 Match: Employer's matching contribution to a pension plan. The Pension Plan box is checked on the W-2.

K - Federal Unemployment: Reported on the Federal Unemployment report.

L - State Unemployment: Reported on the State Unemployment report.

M - Noncash Fringe: Used to report benefits provided to the employee that were other than cash. These can be taxed and reported on the 941 and W-2.

N - Excess Life Insurance: Used to report the premium paid by the employer for any life insurance policy value over $50,000.

O - Excluded Moving Expenses: Used to report excluded moving expenses.

P - Third Party Sick: Reports the sick pay to an employee by a third party. This can be reported on the 941 and W-2 as third party sick pay.

Z - Other: Any other benefit provided to the employee.

In the Method field, use the drop-down list to select the option that determines how the ECB is calculated in Payroll (e.g., per hour, per percentage of gross wages, etc.).

1 - Rate per hour

2 - Percentage of this payroll's gross wages plus a flat amount: Either a flat amount or a percentage as well as both can be used.

3 - Tax Tables: Uses the federal or state (state unemployment) tax tables to calculate the ECB.

6 - % of Fica wages plus flat amount: Calculates a percentage-based withholding based on a taxable wage limit (e.g., California ETT Tax).

The Unit and Method fields cannot be edited if this ECB has check history.

In the Type field, use the drop-down list to select the option that determines the type of benefit. Choose from the following options:

S-Standard ECB - The same amount or percentage is calculated each pay period. Standard ECBs do not have to be re-entered each pay period.

V-Variable ECB - The amount of the ECB is reset to 0.00 after each Payroll. Variable ECBs must be entered through Single Line Time Entry > Variable ECBs each time need to be calculated.

In the Maximum for Year field, enter the yearly limit for the ECB, if needed. When the benefit reaches this limit, it is no longer taken. The limit does not have to be entered for tax contributions – the limits are entered in the tax tables.

In the Maximum for Life field, enter the lifetime limit for the ECB, if needed. When the benefit reaches this limit, it is no longer taken.

In the Default Amount field, enter the amount that you want to default into this ECB each time it is added to an employee. This field can be used if the Method = 1 or 2. Typically, if this is entered, the Default Percentage is blank. Use this option when the ECB amount is the same for all employees.

In the Default Percent field, enter the percentage that you want to default into the ECB each time it is added to an employee. This field can be used if the Method = 2 or 4. Typically, if this is entered, the Default Amount is blank. Use this option when the ECB percentage is the same for all employees.

In the Def. Match Cap % field, enter the maximum percentage the employer will match for the ECB, for example, if the employer will match 50% of the employee deduction up to 4% of the salary, the match cap % = 4.0.

In the Maximum Amount field, enter the maximum amount that the employer will contribute for each payroll run, for example, if the default amount is $25.00, but the maximum amount is $20.00, then $20 is contributed and not $25.

In the Default State field, click the Search button to select the state code for the state your facility is operating in. This state code will default into the ECBs set up for each employee. It can be changed in the Employee ECBs, if necessary.

In the Default GL Account # field, click the Find button to open the List of Chart of Accounts window and select the account number to default on the employee's ECB record. This account is used for credit journal entries of ECB liabilities.

Check the Match box if there is a matching deduction code for this ECB. For example, FICA and Medicare are matching ECBs. If this box is checked, then a matching deduction code must exist.

The Federal, FICA, State, and Local fields cannot be edited if this ECB has check history.

Check the State Taxable box if the ECB is subject to state taxes.

Check the Auto Setup box to automatically create this ECB for each new employee.

Check the Local Taxable box if this ECB is subject to local taxes.

Check the Federal Taxable box if this ECB is subject to federal taxes.

Check the FICA Taxable box if this ECB is subject to FICA and Medicare tax.

The Report as Unemployment Wages box is available when Unit = M - Noncash fringe. Check this box to include the ECB amount in the wages reported in Box 1A (Subject Wages) of Form OQ.

Check the Use Maximum in Master rather than employee box to use the maximum from the master file. The maximums are normally defaulted into the employee’s record. For ECBs, such as 401Ks, the maximum is the same for all employees and is occasionally changed. If this box is not checked, the maximum in each employee ECB will be used as the limit for the ECB.

Check the Update all employee ECB with Default Amount or Default Percent when defaults changed box to update the Amount or Percent fields on the Employee > ECB Information tab for all active employees who have this ECB when the Default Percent or Default Amount field (above) is updated.

In the Frequency field, use the drop-down list to select the option that identifies when an ECB is included in a Payroll run (e.g., always, biweekly, semimonthly). Each time a payroll is calculated, the frequencies can be selected. This frequency does not necessarily need to correspond to the pay cycle indicated, e.g., monthly, quarterly, etc. If the frequency is selected for the payroll, all ECBs and deductions with the selected frequency will be included in the payroll.

In the Vendor field, click the Find button to select the vendor (as set up in the Accounts Payable application) to have an invoice generated for the total liability into AP Invoice Entry when payroll checks are posted.

The Active check box defaults to checked, indicating that the ECB is available for use in the Centriq system. Uncheck the box to make the ECB unavailable/inactive. If unchecked, this ECB will not be active for any employee.

Depending on the selected unit and method, you can indicate which wages (wage codes) should be excluded from the calculation if needed. See To exclude wage codes below.

Click Save to save the ECB and close the window, or click Cancel to close the window without saving.

The Exclude Wage Codes option allows you to specify the wage codes to be excluded from calculation. This option is available for the following scenarios:

Units 9 - 401k, 403b, 457 Match and Z-Other when the ECB amount is a percent of wages.

Unit Z-Other, and the ECB is calculated using the 1-Rate per hour method.

Click the Exclude Wage Codes button. The Wage Exclusions window is displayed.

Click the Search button to select the valid wage code(s) that you want to exclude from the calculation.

Click Save to close the window and return to the Employer Contributions or Benefits window, or click Cancel to close the window without saving.

To remove a wage code, right-click on the wage code and select Delete. You are not allowed to edit or remove wage codes if the ECB has check history. The following message is displayed if the ECB is in use: This ECB master record is associated with existing check history. To maintain an accurate audit trail, this row cannot be removed.

If an exclusion was done in error, and you want to remove the newly-added row before processing your next payroll, contact Support for assistance.

The Edit button allows you to edit the ECB field values or to change the active/inactive status of a ECB.

In the Employee Contribution or Benefits window, find and select the ECB that you want to edit.

Click Edit. The Edit Employee Contribution or Benefits window is displayed.

Edit the fields as needed; refer to the field descriptions from To create a ECB (above).

Click Save to save your changes and close the window, or click Cancel to exit without saving.

Follow the instructions below to delete an ECB from the master file if it is not in use. NOTE: You can also choose to deactivate the ECB, rather than delete it, by unchecking the Active box in the edit screen.

In the Employee Contribution or Benefits window, find and select the ECB that you want to delete.

Click Delete. A verification message is displayed.

Click Yes to delete the ECB, or click No to keep it.

Follow the instructions below to display and/or print a list of ECBs on file.

In the Employee Contribution or Benefits window, choose your search criteria and click Find to display the ECBs that you want to print. All records that are visible in the grid will be included in the report.

Click Print. The report is displayed in the Report Viewer, where you can save the list to the PC/network or print the list to an assigned printer. See To preview the report for more information on options within the viewer.